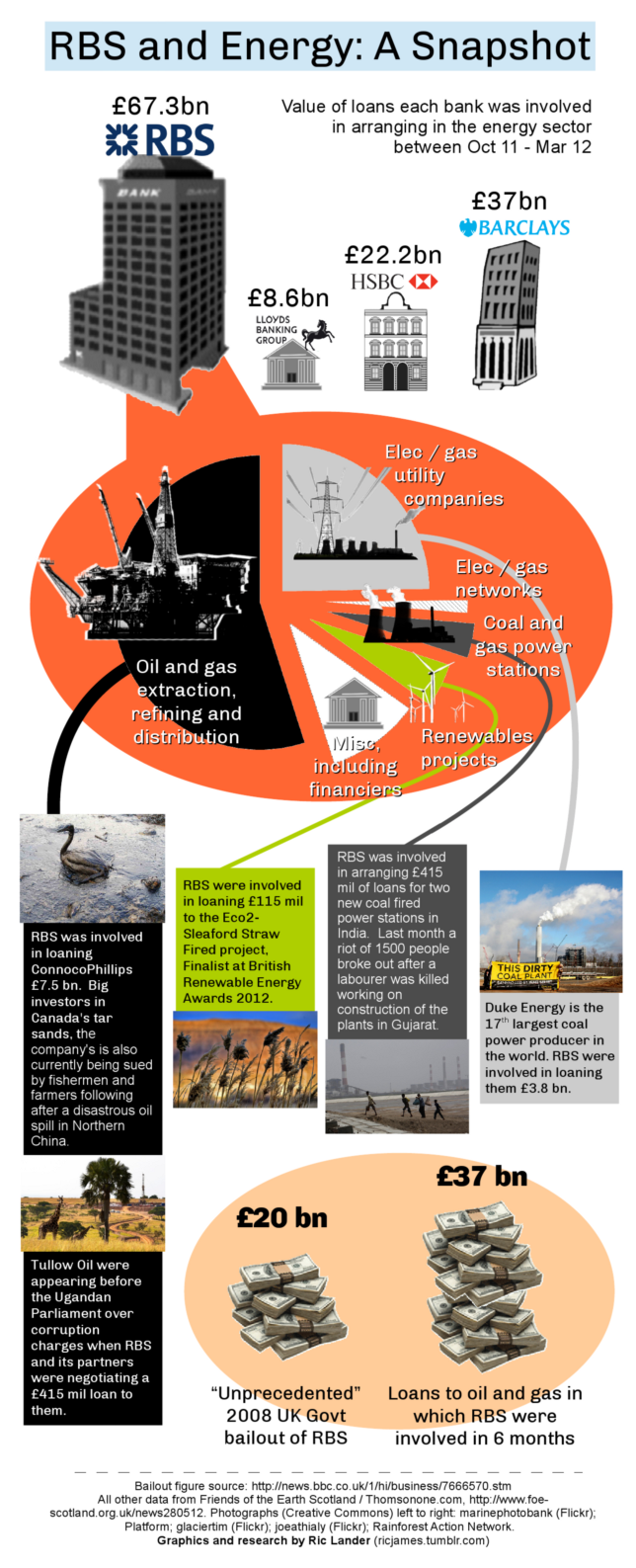

- Loans to renewables dwarfed by oil and gas in Q4 2011 and Q1 2012

- Taxpayer-funded RBS loans undermine Government climate policy

- No sign of change since Government bail-out

As private shareholders gather for the RBS Annual General Meeting in Gogarburn today, there will be an elephant in the room.

Majority shareholder, the UK Government, whose portion is managed by treasury-owned “UK Financial Investments” will not be using their power to stop RBS undermining Government policy to reduce carbon emissions.

Research I helped produce with Friends of the Earth Scotland published in the Guardian on Monday shows that RBS were involved in lending 67.3bn bn of loans to energy and power companies between October 2011 and March 2012, more than half of which was lent to oil and gas corporations. Only 5% went to funding renewable energy projects.

This comes only a week after the UK Government announced ambitious plans to reduce carbon emissions from UK electricity generation, including a reduced reliance on coal.

The research unermines the Coalition’s claim that returning RBS to profitability should be the only aim for UKFI. RBS’ loan activities directly oppose Government efforts create a sustainable economy, and will increase the cost of the impacts of climate change on the UK in the future.

As well as increasing carbon emissions, companies which RBS has recently been involved in funding have had been under fire for corruption and human rights abuses. The RBS AGM will take place away from prying eyes this afternoon at their out-of-town conference centre, RBS Gogarburn near Edinburgh.

RBS customers under the spotlight:

- Adani Power Ltd, India. £415 mil. deal closed 30-12-2012. RBS was involved in arranging loans for a coal fired power station project in Kutchh District, Gujarat. The two plants together have an operating capacity larger than Cockenzie power station. Despite the carbon intensity of the project, it has receieved controversial ‘Clean Development Mechanism’ credits where the operator can be paid for efficiency improvements relative to if no such additions were not installed. A riot of 1500 people recently broke out after a labourer was killed and two others critically injured working on the plants’ contruction.

- Enel Finance International SA Luxembourg £2.7 bn deal closed 20-02-2012. Enel is the 23th largest coal-fired electricity producer worldwide by operating capacity…

- …and Duke Energy is the 17th largest. Duke Energy Corp, USA. £3.8 bn deal closed 18-11-2011.

- Tullow Oil Plc., UK. £415 mil closed 30-11-2011. Whilst RBS and its partners were closing a deal with Tullow Oil, the company was appearing before the Ugandan Parliament over corruption charges.

- ConocoPhillips Co, USA. £7.5 bn closed 22-02-2012. ConocoPhillips, the company’s Chinese division was being sued by fishermen and farmers following after a disasterous oil spill in Bohai Bay, Northern China. The spill spread over 6,200 square km of water and caused huge losses to tourism and aquatic farming. The Chinese Institute of Public and Environmental Affairs has accused ConocoPhillips of covering up the damage during critical pereods after the spill in 2011. ConocoPhillips is also one of the largest investors in the Alberta Tar Sands, causing widespread destruction to the region’s pristine forests and damaging resources owned by First Nations peoples.

(All new data from Friends of the Earth Scotland / Thomsonone.com, see FOES online)

This post was originally published on Bright Green Scotland.

Leave a Reply